Starting January 1, 2021, we are required by law to apply sales tax to all charges when the company billing address is located in a taxable state. This change is a result of either 15Five meeting or exceeding NEXUS requirements in certain states OR states enacting new sales tax legislation, thus requiring the collection of sales and use taxes accordingly. Depending on your tax exemption status and location, local and state sales tax charges may be added to your invoice.

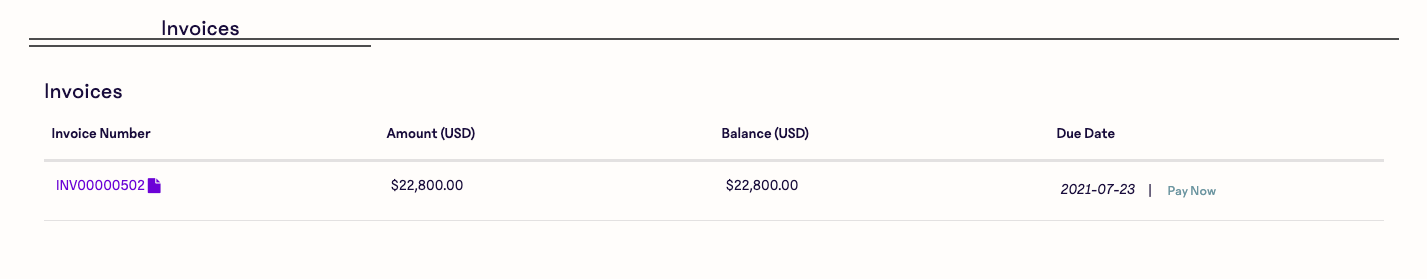

These sales tax charges are indicated by a separate line item on your invoices. Invoices can be viewed under the 'Invoice' tab in the Billing Portal.

To get to the Billing Portal, click Manage Billing Details from your 'Billing' page.

If you have questions, reach out to AR@15five.com.